when does capital gains tax increase

The capital gains tax is the levy on the profit that an investor makes when an investment is sold. First its important to distinguish between income tax rates and the lower capital gains and qualified dividends tax rates.

How Does Capital Gains Tax Affect Inherited Property.

. The top rate would be 288 when combined with a 38 surtax on net investment income. 247 Access to Reliable Income Tax Info. Compare Your 2022 Tax Bracket vs.

The rate jumps to 15 percent on. Taxpayers in the 25- 28- 33- or 35- percent income tax brackets face a 15 percent rate on long-term capital gains. Both the Tax Foundation and the Penn Wharton Budget Model find that effect.

Capital gains revenues did increase two years after the 1981 capital gains and general tax rate cuts as the economy recovered from the 1981-82 recession. The long-term capital gains tax. Capital gains tax on estate property can kick in if the property is sold at a higher price than its purchase price.

If that 15000 were from short-term gains your AGI would be 50000. Long-term isnt really. Capital Gains and the Length of Your Investment In terms of your capital gains the IRS breaks them into two main categories.

This implies that the taxpayer paid an effective rate of 279 percent on the real gain. So when asking whether capital gains will push you into a higher tax bracket the primary question is whether those earnings were made within a year or longer. In 2022 it would kick in for single filers with.

When the rate goes up not only do investors cut back on new investment those with pre-existing gains hold on to them longer. Assets subject to capital gains tax include stocks real estate cryptocurrency and businesses. Individuals earning up to 9950 and married couples earning up to 19900 are in the 10 tax bracket.

35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for people earning over 400000 or those in the highest tax bracket. This means that high-income investors could have a tax rate of up to 396 on short-term capital gains. Biden is set to propose a sharp increase in capital gains tax to 396 from the current 20 level for those making more than 1 million a year according to reports in the New York Times and.

Talk to Certified Business Tax Experts Online. Urban Catalyst is a leader in QOZ investing. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

Single filers with income over 523600 married filing jointly with income over 628300 head of household filers with income over 523600. Get Tax Lein Info You Can Trust. The end result is less revenue.

It is owed for the tax year during which the investment is sold. Its the gain you make thats taxed not the amount of money you receive. Ad Ask Independently Verified Business Tax CPAs Online.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. Tax rates generally increase when your income increases. This means that the tax impacts the person who inherited property.

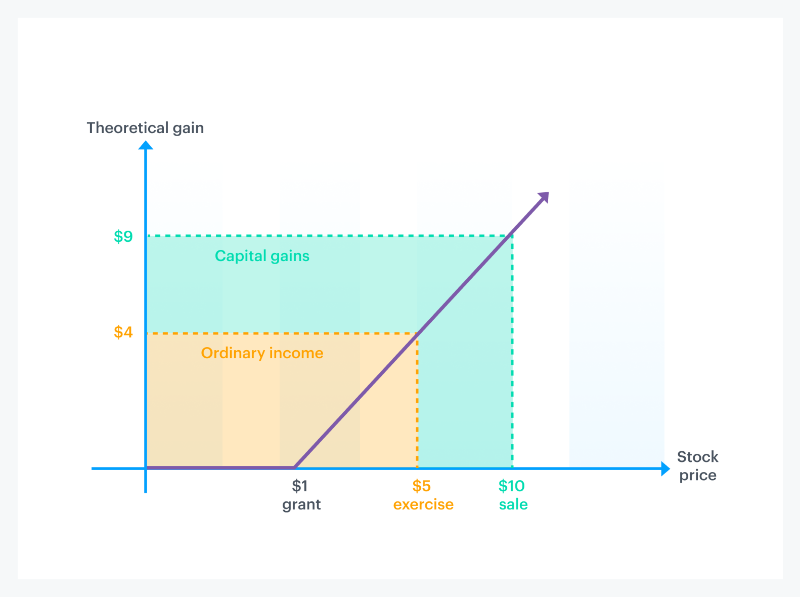

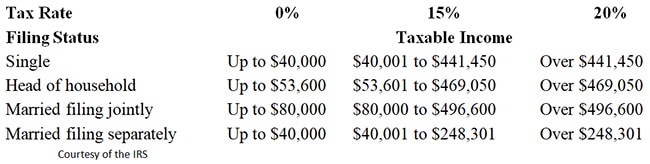

The Biden administration recently released plans to increase the top capital gains tax rate for people earning over a million dollars a year. The first thing you need to know about capital gains tax is that they come in two flavors. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more on how to calculate your.

For 2021 the top tax bracket includes the following taxpayers. This would take effect in 2022. Tax brackets vary based on your filing status.

The top rate for capital gains tax may increase from 29 to 49 percent state and federal rates combined. As of 2021 the long-term capital gains tax is typically either 0 15 or 20 depending upon your tax bracket. As a result he realized a capital gain of 9249 and must pay the 238 percent tax 16 of 2201 on this nominal gain.

The top rate high-earning Americans pay. The new rate would apply to gains realized after Sep. Long-term capital gains tax on stocks.

Your 2021 Tax Bracket To See Whats Been Adjusted. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. Individuals earning up to 9950 and married couples earning up to 19900 are in the 10 tax bracket.

The difference between income tax and capital gains tax rates. Raising the capital gains rate is also self-defeating from a revenue perspective. The dumbest tax increase indeed.

However since there was inflation during this period the real gain was actually only 7879. Capital gains are generally included in taxable income but in most cases are taxed at a lower rate. Lets continue to say that you made 35000 in 2020 and earned an additional 15000 from investments.

Thus for households earning more than 1 million the capital gains tax rate would increase from 238 to 434 as of April 28 2021 thus eliminating the opportunity to recognize gain at current rates in advance of the legislation. The more you make the higher your tax rate. Capital gains tax is the tax you pay after selling an asset that has increased in value.

Capital Gains Tax Rates for 2021 The capital gains tax on most net gains is no more than 15 for most people. Lily Batchelder and David Kamin 2019 using JCT projections 2016 estimate that taxing accrued gains at death and raising the capital gains tax. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Taxpayers in the 10 and 15 percent tax brackets pay no tax on long-term gains on most assets. Lets go over the 2021 lower bracket income tax rates. However after the 1986 capital gains tax increase capital gains tax revenues continued to increase along the same trend again with a large spike in the 1986 fire-sale year.

Ad Discover Helpful Information And Resources On Taxes From AARP. Would tax capital gains and dividends for the rich at among the highest rates in the developed world if President Joe Biden s proposal was enacted.

Paul Ryan Budget Business Insider Capital Gains Tax Budgeting Income Tax Brackets

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Trust Tax Rates And Exemptions For 2022 Smartasset

What Is The Rate Of Capital Gains Tax In The Uk Capital Gains Tax Capital Gain Accounting Services

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Tax

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Florida Real Estate Taxes What You Need To Know

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Capital Gains Tax What Is It When Do You Pay It

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)